Everything you need to know about car damage categories

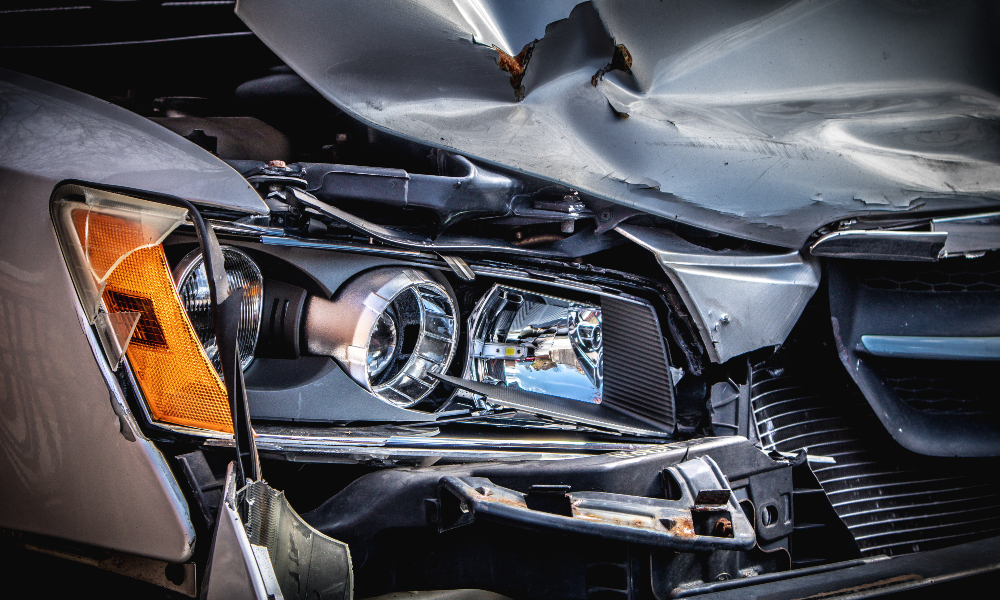

Here’s a term that no driver ever wants to hear: “write-off”.

If you’ve ever been unfortunate enough to have wound up in a car accident, leaving your car looking a little worse for wear, you’ll realise there’s a whole lot to learn about the different types of car damage categories. Insurers use these categories to judge the severity of the damage on your car, so they can ultimately decide whether or not it can be repaired or if it’s off to the great scrap heap in the sky. However, things can get a little confusing.

So, let’s clear things up with a deep dive into the world of write-offs and car damage categories, and explain what this all means for your car, and your bank account.

What are the different car damage categories?

When an insurer assesses a broken vehicle and deems it a write-off, the level of damage is divided into four categories. According to recent studies, one car gets written off every single minute in the UK, totalling to around 384,000 a year! As such, it’s worth getting clued up on what a write-off marker could mean for you. Before the 1st October 2017, these car damage categories were A, B, C, and D, but they’re now labelled A, B, S, and N, both starting with category A as the most severe.

It’s still worth knowing the old car damage categories, as many people still use them to this day. Let’s go ahead and find out what they all mean:

Old car damage categories

- A – A total write-off where the entire car needs to be scrapped or crushed

- B – The body-shell of the car must be scrapped, but some parts are salvageable

- C – Repairable but the costs will be higher than the car’s original value

- D – Repairable and the costs don’t exceed the car’s original value

New car damage categories

- A – Same as before

- B – Same as before

- S – Repairable structural damage

- N – Repairable non-structural, cosmetic damage

The category S definition is when your car has encountered structural damage like a bent chassis or suspension damage, and you’ll not be allowed to get behind the wheel again until all these (expensive) repairs have been carried out.

Category N is non-structural damage that’s typically just aesthetic, including damage to the bodywork or bumper. Don’t assume you can hit the roads straight again, as cat N could also include integral parts like your braking or steering.

Category D isn’t used anymore, but it’s when the car has suffered relatively minor damage. It’ll still be uneconomical for the insurer to carry out the repairs, but the cost will be reasonable if you want to fulfil them yourself.

Insuring a damaged car and getting it roadworthy again

When your vehicle is deemed a car insurance write-off, it can prove quite tricky to source car insurance once again for that vehicle. Of course, if your car is deemed category A or B, it’s a goner. However, you might be in luck with a cat S car or a cat N. Despite this, many providers refuse to insure a previously damaged car.

However, if you do manage to source appropriate cover, you’ll need to demonstrate that your car has undergone the necessary repairs. And unfortunately, insuring your previously damaged car may come with a hefty price tag as the car is at more risk.

Do I need another MOT for a cat N or cat S car?

If you choose to get your car back out on the road, you must have a valid MOT and road tax. Surprisingly, the DVLA doesn’t require a recent category N car to have a new MOT before returning to the roads. However, with a cat S car, a new MOT is necessary.

Buying a car insurance write-off

If you’re buying a secondhand vehicle, it’s important to be aware that it may be a previous car insurance write-off.

Cars tainted with one of the car damage categories are of course worth considerably less, and a seller is legally required to inform any potential buyer of the car’s history. So, if you were buying a cat N car, it’s important to get a professional inspection before signing anything – you don’t want to get caught out.

Buying a secondhand car insurance write-off for yourself can prove considerably cheaper, but this depends on the repair costs and if you can find a reasonable insurance price.

Is buying a secondhand write-off car worth it?

Unfortunately, the answer to this question is not exactly black and white. However, the reasons all boil down to money.

You’ll find that buying a cat N car or cat S car secondhand can save you a lot of money upfront. However, when it comes to the repair costs and the insurance costs if you’re buying it for yourself, it can hit your bank account hard. It’s up to you to do the maths here to determine if it’s worth it for you.

If that particular car model holds some sentimental value to you, or you’re a car enthusiast, the small savings might be worth it. If you’re buying the vehicle with intent to sell, do the workings out to ensure it’ll be profitable for you. Remember, cat N and cat S cars sell at a lower price, no matter how nifty you’ve been with the repair job.

Help! My car needs repairing

Overall, it may feel like a minefield trying to figure out all the car damage categories, and of course, it can be hard to know your best options for repairs.

Here at Vasstech, we’re the experts. So, if you’ve found yourself stuck in a jam and your car needs a little TLC, don’t hesitate to get in touch with your local Vasstech branch – we’d love to help.